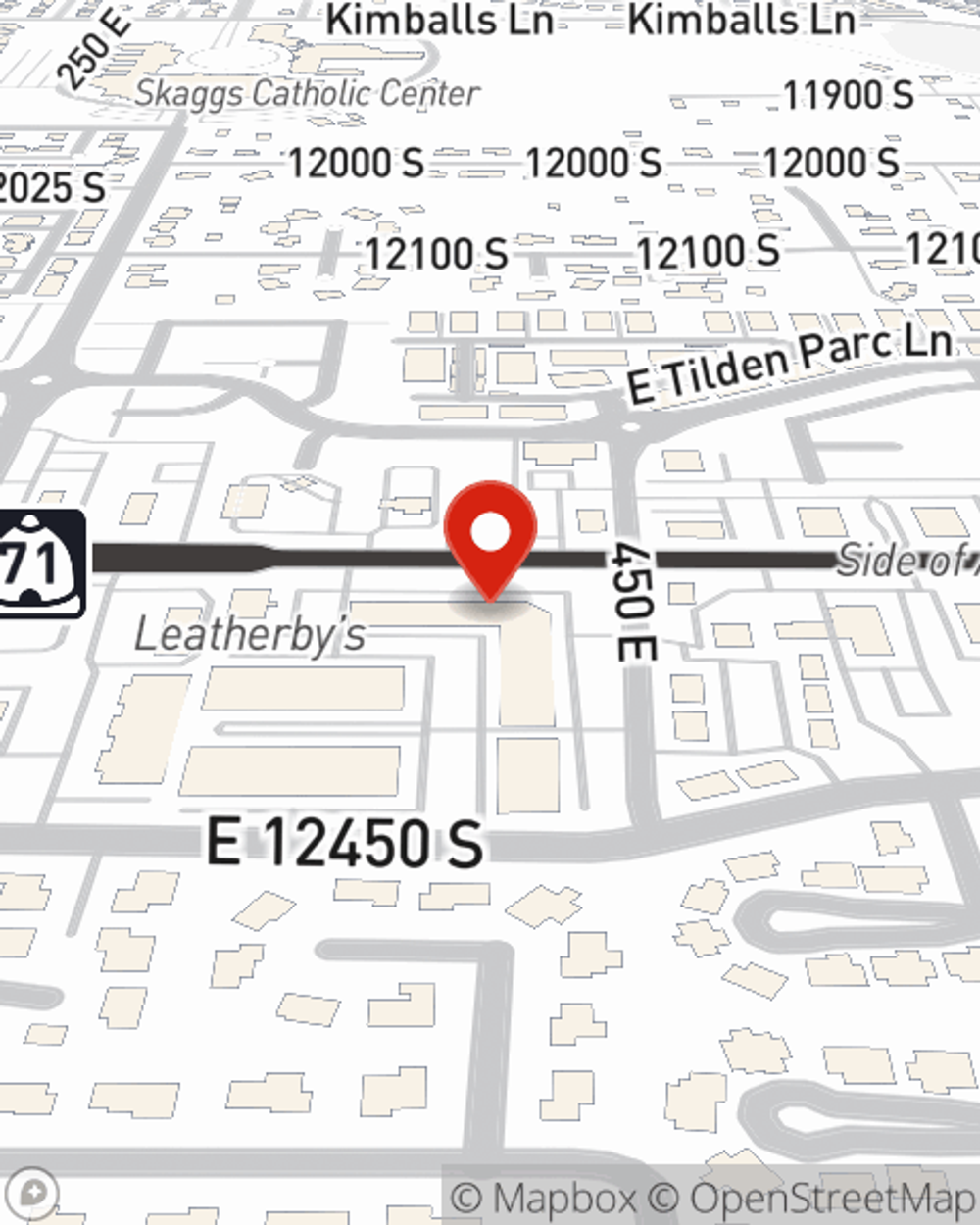

Business Insurance in and around Draper

Calling all small business owners of Draper!

No funny business here

- Draper

- riverton

- Herriman

- Bluffdale

- Sandy

- South Jordan

- Murray

- Lehi

- American Fork

- Cedar Hills

- Pleasant Grove

- Orem

- Provo

- Lindon

- Saratoga Springs

- Eagle Mountain

- Springville

State Farm Understands Small Businesses.

It takes courage to start your own business, and it also takes courage to admit when you might need support. State Farm is here to help with your business insurance needs. With options like business continuity plans, a surety or fidelity bond and worker's compensation for your employees, you can rest assured that your small business is properly protected.

Calling all small business owners of Draper!

No funny business here

Protect Your Business With State Farm

Whether you own a floral shop, cosmetic store or a farm supply store, State Farm is here to help. Aside from outstanding service all around, you can customize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Agent Mike LeBaron is here to review your business insurance options with you. Reach out Mike LeBaron today!

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Mike LeBaron

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".